The Weekly Sitrep

Restricted Stock Units: What are they and are they worth taking a lower base salary for?

Happy Monday Sitreps Team!

In this edition of the weekly sitrep, I wanted to talk about restricted stock units (RSUs) and how to decide on when to forgo a higher base salary in exchange for more RSUs. I think this is important because many veterans are entering the tech sector where RSUs are used as a common form of compensation.

The Basics - What are Restricted Stock Units?

A restricted stock unit (RSU) is an award of stock shares, usually given as a form of employee compensation. The recipient must meet certain conditions before the restricted stock units are transferred to the owner.

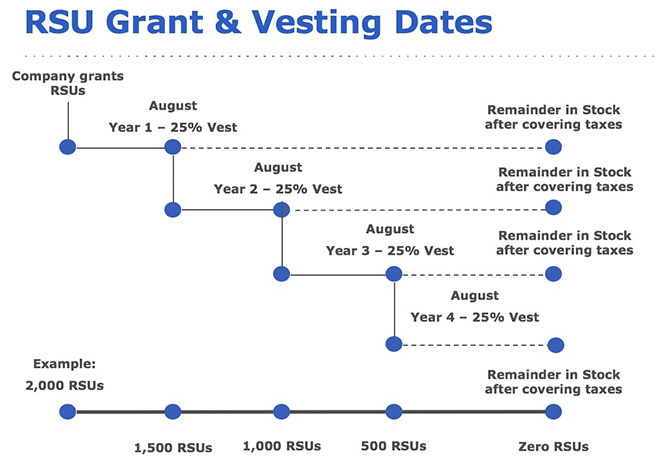

Restricted stock units are issued to employees through a vesting plan and distribution schedule after they achieve required performance milestones or upon remaining with their employer for a particular length of time.

Restricted stock units give employees interest in their employer's equity but have no tangible value until they are vested. The RSUs are assigned a fair market value (FMV) when they vest. Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes. The employee then receives the remaining shares and has the right to sell them.

Practical Example:

Upon leaving the military, you accept an offer with a public big tech company. The Company is going to pay you $100K a year in base salary and $100K in restricted stock units. The stock vests over a period of 4 years with a vesting schedule of 25% each year. In addition you will have vesting events quarterly. So that 25% is divided by 4 quarters (6.25% a quarter). The stock is currently valued at 100 dollars a share. You will therefore receive an equity grant of 1000 shares on the day you begin employment.

Keep reading with a 7-day free trial

Subscribe to The Weekly Sitrep to keep reading this post and get 7 days of free access to the full post archives.